Thomas Insurance Advisors - Questions

Wiki Article

Thomas Insurance Advisors - The Facts

Table of ContentsThomas Insurance Advisors Things To Know Before You BuyHow Thomas Insurance Advisors can Save You Time, Stress, and Money.An Unbiased View of Thomas Insurance AdvisorsThe 2-Minute Rule for Thomas Insurance Advisors

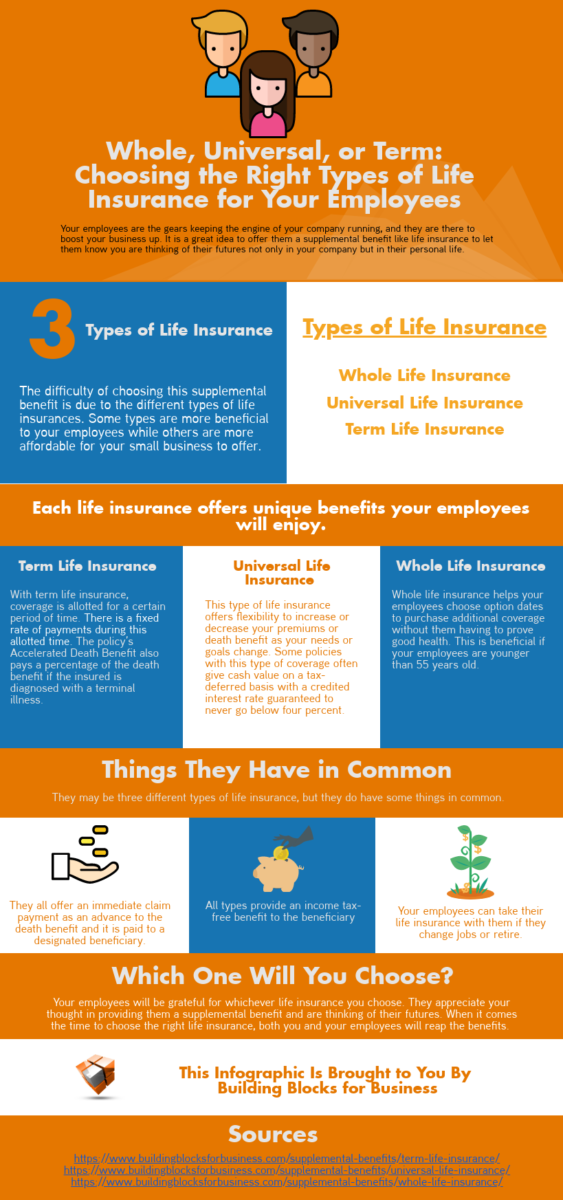

Since AD&D just pays out under details scenarios, it's not a suitable replacement for life insurance policy. https://www.producthunt.com/@jstinsurance1. AD&D insurance policy just pays if you're injured or killed in a crash, whereas life insurance coverage pays for a lot of reasons of fatality. As a result of this, AD&D isn't suitable for everyone, but it may be beneficial if you have a high-risk profession.Pro: Expense whether it's used as a benefit via your company or you buy it on your very own, plans are usually inexpensive. Con: Limited coverage AD&D covers you just under details scenarios, whereas a traditional life insurance coverage plan uses a lot more detailed protection. Joint life insurance policy is a life insurance policy plan that covers two individuals.

The majority of joint life insurance coverage policies are irreversible life insurance coverage policies, which last your whole life and also have an investment-like money value function that earns passion. Home Owners Insurance in Toccoa, GA. Joint term life insurance policy policies, which run out after a set duration, do exist but are much less typical. Pro: Convenience joint plans can cover two people if among them doesn't get approved for insurance coverage, or if getting 2 different plans is out of budget.

Best for: Couples that do not certify for two private life insurance policy policies. There are two primary kinds of joint life insurance policy plans: First-to-die: The policy pays out after the first of the 2 partners passes away.

The smart Trick of Thomas Insurance Advisors That Nobody is Discussing

, works best as a windfall to a reliant. It doesn't provide any earnings replacement for your partner if you pass away prior to they do. Plans last a year or less and safeguard you if you can't obtain cost effective costs due to an existing health problem or you're waiting for your insurance provider to come to a choice on your application.

No-medical-exam life insurance coverage typically describes term life policies that do not require the test, but other kinds of insurance policy, like streamlined problem, do not need the exam, either. These types of plans also come with shorter waiting periods, which is the space in between the minute you start the application procedure and also the minute your plan becomes efficient.

Best for: Anybody who has few health and wellness problems. Pro: Time-saving no-medical-exam life insurance policy supplies faster access to life insurance without needing to take the medical test. Con: People who are of old age or have multiple wellness problems might not be eligible. Supplemental life insurance policy, also called volunteer or volunteer additional life insurance policy, can be made use of to link the coverage space left by an employer-paid group policy.

The Greatest Guide To Thomas Insurance Advisors

You'll generally experience supplemental life insurance policy as an optional employee benefit used along with your basic team life insurance policy, yet not all companies supply this advantage. Supplemental policies are usually gotten through your company yet can be purchased privately. If you acquire this type of policy through your employer, you might shed it if you leave the business.

Pro: Convenience surefire accessibility to added coverage when offered as a benefit by an employer. Con: Limited protection you'll typically need an extra term policy to get all the protection you need. Simplified whole life insurance coverage, a kind of streamlined problem life insurance policy, supplies a percentage of long-term life insurance policy protection to those that do not certify click over here for other policies, and it does not require a medical test.

(There are some business that provide simplified concern term life insurance policy also, yet it's much less typical.)The shorter application procedure gets you coverage quicker, however because the wellness examination isn't as detailed, insurers set a higher costs for a lower protection amount. Simplified problem policies can aid senior citizens or people with specific pre-existing conditions, like a history of particular kinds of cancer cells or stroke, get insurance coverage to pay for last expenses.

Pro: Convenience simplified issue policies supply tiny coverage amounts for final expenses without having to take the clinical examination. Disadvantage: Price greater costs for a reduced protection quantity.

More About Thomas Insurance Advisors

Report this wiki page